Have you ever thought about whether you should get loan finance to buy a used caror a brand-new one? Either way, for sure, you did. However, you are probably wavering about your plans. Do not worry since that is quite normal. It is only natural for you to have doubts since it concerns your finances. So, take your time, and try not to overwhelm yourself too much. Once you are already calm, start gathering information about why you should consider getting one right now.

It would help if you first identify the inconveniences that you are experiencing with your current income. Try to think about it whenever you want to buy something. Count how many times you check out someone else’s car. Or the times you went to a car dealer to inquire how much your dream car would cost. Isn’t that pretty annoying? You keep doing things back and forth, yet you could not afford to get the vehicle you want for a long time. For sure, most people, especially the younger generation, feel the same way.

Nevertheless, that does not mean you would give up the thought of buying yourself a vehicle. You could still have one through a different option—car finance allows you to get a newor used car. Well, if that does not convince you, then you better read through this article. Here, you would understand more why you should get one and what you should do afterwards. So, keep your eyes peeled and your mind open.

Is Car Financing For You?

For sure, this option surprises you the most. Probably, you feel a bit shameful to ask for a little help—loan finance to buy a new or used car. However, this option is not bad at all. You could get what you want without putting so much pressure on your savings. Well, to convince you more, read the pros and cons below.

Pros of Car Financing

Purchased Dream Vehicle Without Money Down

Naturally, once you receive a car loan, you would not have to pay for the cost upfront. As a result, you do not have to worry about monthly payments, and you could use what you have for something else. Perhaps, using your money for investment.

Improve Your Credit History

It sure does, but as long as you settle your repayments on the dot. Once your credit history increases and becomes trustworthy, it would be easier for you to get a home loan.

Get the Dream Car at Lowest Possible Rates.

Either a used or new car loan calculator in Singapore comes with the lowest possible rates. That means it would not take long before you could settle the cost of your dream car since the total interest rate will be lower.

Better Perks and Benefits

If you pay for your dream car in full, you would not have to worry about the interest rate nor monthly fees later on. Also, there is a possibility that the car insurance coverage may change.

Cons of Car Financing

There are Interests and Fees

Of course, and it would depend on how much money you need. The higher the car finance is, the higher the interest rates and fees are. So, make sure to borrow the right amount you need to complete your purchase.

Car Depreciates Its Value Over Time

That means that what you need to pay for later does not change even if the market changes.

Now, are you finally concerned to get loan finance to buy a new or used car? As you can see here, the pros indeed outweigh the cons. That means, one thing, it would help you get the dream car you always wanted.

Your Top Questions About Car Financing, Answered.

We get it. You are interested in applying for car financing to get yourself a new vehicle. However, things could get confusing if you have not done it in the past. More so, if you have so many questions in mind. So, to get things clear and help you understand car financing more, read the following questions below. Remember each answer so you would have peace of mind.

Question 1: Is Application for Car Financing Free?

The shortest answer is yes. You would not have to pay for anything when applying for car financing online. However, you have to make sure that you submit every requirement right.

Question 2: Who Is Eligible for Car Financing?

Honestly, anyone is eligible for car financing. They just have to be at the legal age living or staying in Singapore. Even ex-pat could get car finance if they want a new car for themselves.

Question 3: What Are the Requirements for Car Financing?

Besides a copy of your NRIC (National Registration Identity Card), you also need to submit your income documents. These files contain your latest CPF (Central Provident Fund), a two-year notice of statement, and your payslip for the last three months. Also, try not to forget to include the sales & purchase agreement you got from the car dealer of your choice.

Make sure to prepare the following documents above when you decide to get loan finance to buy yourself a used or new car.

Question 4: How Long Does It Take to Receive Approval?

The process of car financing application does not take long. You would only need to wait for at least a week or two to get approval. If you could not wait that long, make sure you submit everything they need as clearly and concise as possible.

Question 5: Do I Need a Guarantor?

Most car financing companies require their applicants to have at least one guarantor. It rests assured them that you would pay back what you had borrowed from them. Therefore, know which people you know can be your guarantor before applying for loan finance to buy yourself a new or used car.

Question 6: Should I Apply for Car Financing Before or After Choosing a Vehicle?

It depends on what you want to happen. However, if you desire to get your dream car, make sure to apply for one after choosing a vehicle. That way, the financing company would know how much money they have to lend you. So, make sure to look for a reliable car dealer and request a sale and & purchase agreement. This document will help your application run smoothly.

Question 7: Can I Get Car Financing Even If I Am Self-Employed?

Of course, you can! Applying for car financing is for everyone who wants to own a car. So, if you believe that your savings could not afford to pay for your dream car, consider getting car finance. Just make sure you provide a clear copy of your financial statement when you submit your application.

Question 8: What Are My Car Financing Options?

Besides car financefor a usedand new car, you could also get in-house used car financing. Additionally, some offer direct hire purchase and COE renewal loan. So, wisely choose which one you indeed need to get.

At this point, is there anything you do not understand about car financing? If there is none, then proceed reading the following. You would find out below what you need to do once you decide to get loan financeto get yourself a usedor new car.

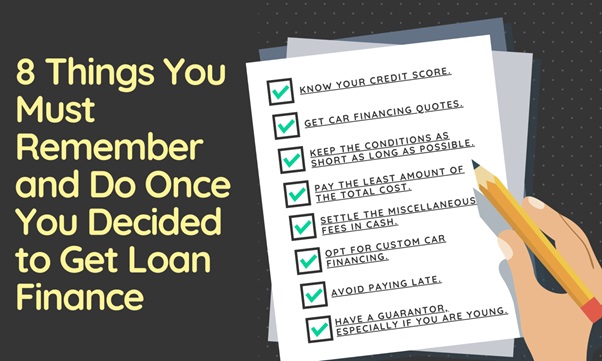

Things You Must Remember (and Do) Once You Decided to Get Loan Finance.

Great! You have decided to get car finance to get yourself a vehicle. However, before you could get one, there are things you must do first. That way, you would get car financing approval faster and would not encounter any problems later on. Here, take a look at what you need to remember and do.

Know Your Credit Score.

Applying for car financing is different from getting a mortgage. Here, you could get one even if you have a low credit score. The only issue you may encounter is you will have a higher interest rate. So, make sure yours is not at the least to no credit score at all.

Get Car Financing Quotes.

Before you settle your agreement with the car dealer of your choice, you would need to know how much money the car financing company could lend you. That way, you would find out if you could get your dream car or not. If the latter happens, you would have more time to choose another vehicle that meets your budget.

Keep the Conditions as Short as Long as Possible.

In this way, you would only need to pay what you have borrowed in a short time. Also, the interest rate of your car financing would not be high. As a result, you would end up saving more in the long run.

Pay the Least Amount of the Total Cost.

For sure, even if you apply for car financing, you have at least 20% of the total cost of the car of your choice. If you could pay the down payment, the terms of your car financing will be different. It cuts the paying time in half, and the interest rate will be lesser. As a result, you would be able to pay back your car financing as quickly as possible.

Settle the Miscellaneous Fees In Cash.

If you do this, your car financing would not have to shoulder the miscellaneous fees. As a result, the amount of money you would borrow will be much lower, so, try to settle what you can and note down what the car finance would cover for your new or used car.

Opt for Custom Car Financing.

If you choose the default one, the car financing company would have the right to own your vehicle. Of course, you prefer not to let that happen. So, see if they offer a custom car financing plan. That way, you could adjust the terms and conditions based on your needs and wants. Once done, make sure you request a soft and hardcopy. It will help you a lot in case you encounter any problems later.

Avoid Paying Late.

As much as possible, try to get rid of your habit of paying for things later. So, you would not have to pay for the additional late fees or be in sticky situations. Well, to not let this happen, make sure to set your reminders on so you would remember when you should pay back your car financing.

Have a Guarantor, Especially if You Are Young.

As mentioned above, you have to since it secured the car financing company that you would pay back what you have borrowed. So, make sure to look for someone who you can trust. Once you have someone in mind, let your friend or family member know they need to provide you with a clear copy of NRIC and income documents. It would be better if they could send you a soft and clear copy of these files.

Once you follow these things, it would be easier for you to seek a car loan estimate. So, you better remember to do these things first before you apply for car financing in Singapore.

So, Should You Get Loan Finance to Buy a Used Car?

That is alright if you do not yet have an answer. Just take your time and think about things thoroughly. Remember, in-house used car financing is not something you could decide easily. You have to know if the pros weigh more than the cons. In other words, if the odds work for you. So, try not to hurry just because you want to buy your dream car. Understand at least the consequences you would have to face later on if you apply for car financing.

So, when you feel like you are ready to get loan finance to buy a new or used car, go to SweeSeng Credit! They can help you settle the payment for your dream vehicle. Visit their website today, and get a custom-tailored solution.Did you find this article helpful? Well, why don’t you share it on your social media? That way, others would know if they should get loan finance to get a new or used car.